waterbury ct taxes paid

Let Payright customize a payroll experience based on your sophistication and needs not just by how many employees you have. Taxes must be paid within a month of the due date.

Bankruptcy Lawyer Waterbury Ct Law Offices Of Ronald I Chorces

You can come into the Tax Office and we can print one for you or you can print it out from your home.

. The program grants credit against tax payments. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. Remember to include your payment stub with your check.

Contact the Assessors office at 203574-6831. 800am - 430pm Fri. View Cart Checkout.

City employees to produce accurate information in a format that enables the safeguarding maximization of resources services. Waterbury Tax Records Search Links. You can call the City of Waterbury Tax Assessors Office for assistance at 203-574-6821.

It may take an additional 24 to 48 hours for DMV to clear you after your payment is processed. By State Statute bills not paid or postmarked by August 1 will be charged 1 -12 percent interest from the original due date of July 1 2022. Was this page helpful.

Every district then is allocated the assessed amount it levied. There are three primary phases in taxing real estate ie formulating tax rates assigning property market worth and taking in receipts. Updated 11282012 1000 AM.

Credit card payments - 25 E checks - 200 Warning About Electronic Bill Payment Telephone Bill Pay Services Visa Debit - 395. For more information call. Payments made online could take up to 72 hours to process.

Visa Mastercard American Express or Discover cards are accepted. Pay Your Car Real Estate and Property Taxes Pay Your WaterSewer Bill Mail-In Payments. Southbury CT 06488 Maps and Directions.

DMV Change of Address. The 1 st installment of Real Estate and Personal Property tax bills as well as Motor Vehicle tax bills will be due July 1 2022. Make checks payable to.

Remember to include your payment stub with your check. When contacting City of Waterbury about your property taxes make sure that you are contacting the correct office. Sales Tax Breakdown Waterbury Details Waterbury CT is in New Haven County.

Please call the assessors office in Waterbury before you send documents or if you need to schedule a meeting. Following the last day to pay August 2 2021 interest at a rate of 15 per month back to the original due date of July 1 2021 will be applied on all delinquent tax balances per Sec. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records.

Never worry about missing a deadline or being penalized for an error. Income limits for the program are set annually by the Office of Policy and Management. 12-130 of the Connecticut.

The City of Waterbury tax office sends tax bills only ONCE PER YEAR. Call 1-855-828-2229 to help us customize a solution for you. Tax Collector City of Waterbury.

Applications are accepted in the Assessors Office from February 1st to May 15th. WHAT SHOULD I DO. City Of Waterbury CT.

06701 06702 06703. Departments Tax Collector Tax Collector. If your bill is greater than 200 and you choose to pay in two installments please be sure to retain part B of the tax bill for the January payment.

You also have an option to pay your sewerwater bill. If not there is an interest charge of 15 per month 18 annually from the due date with a minimum interest charge of 200 per bill. Contact the Assessors office at 203574-6821.

Median property taxes mortgage 4565. Please call service provider or visit website to learn more about eligibility requirements. You will need to have your tax bill available.

The last day to pay without penalty will be August 1 2022. Home Shopping Cart Checkout. CT 06385-2886 800 AM - 400 PM Monday-Friday 860 442-0553.

Account info last updated on Jun 4 2022 0 Bills - 000 Total. The Tax Office takes great pride in serving the taxpayers of Middlebury. Revenue Bill Search Pay - City Of Waterbury CT.

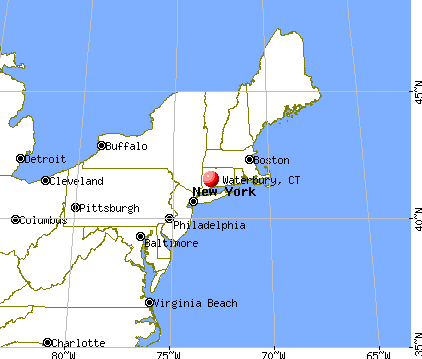

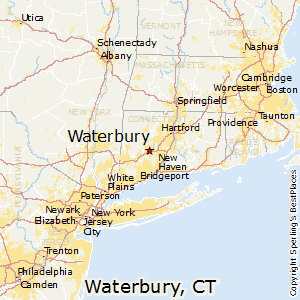

A courtesy reply envelope is included with your tax bill. Waterbury is in the following zip codes. Waterbury CT Sales Tax Rate The current total local sales tax rate in Waterbury CT is 6350.

P203 262-0654 F203 264-9762 Monday - Thursday. If you have delinquent motor vehicle taxes please be aware that DMV clearances are now only done electronically. If your bill is greater than 200 and you choose to pay in two installments please be sure to retain part B of the tax bill for the January payment.

I AM BEING INPROPERLY BILLED FOR A MOTOR VEHICLE. The report for all the taxes that you paid in calendar year 2021 is available to you in several ways. PAY APPLY COVID-19 Finance The Department of Finance maintains financial management systems as well as sustains communicates and enforces an effective internal control structure to allow.

Paying Taxes by Phone. Please write your account number on the check. Free Waterbury Property Tax Records Search Find Waterbury residential property tax records including land real property tax assessments appraisals tax payments exemptions improvements valuations deeds mortgages titles more.

The December 2020 total local sales tax rate was also 6350. Call or visit website for additional information. Tax Pay File in Waterbury CT Payright Payroll Affiliates offers a unique payroll experience.

Request for Tax Bill. Income includes wages pensions Social Security payments and interest on savings. Box 2216 Waterbury CT.

To pay your bill by phone call 1-866-843-5096. I AM BEING INPROPERLY BILLED FOR A MOTOR VEHICLE. Request for Taxes Paid.

Paying Taxes by Phone To pay your bill by phone call 1-866-843-5096. Waterbury ct 06708 internal revenue service advisory consolidated receipts 7940 kentucky dr stop 2850f florence ky 41042 solely for any inchoate estate taxes state of connecticut dept. Town of Woodbury CT.

CT - New Haven County - Waterbury Fees. City of Waterbury CT. Please contact provider for fee information.

12-146 of the Connecticut General Statutes. Typically the taxes are collected under a single billing from the county. See reviews photos directions phone numbers and more for Pay Excise Taxes locations in Waterbury CT.

WHAT SHOULD I DO. Remember to have your propertys Tax ID Number or Parcel Number available when you call. Failure to receive a bill does not invalidate the tax or any penalties accrued per Sec.

The City of Waterbury tax office sends tax bills only ONCE PER YEAR. To pay your tax bill online please click here. 800am - 100pm Department Members.

Waterbury Connecticut Ct Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

38 Cooke St Waterbury Ct 06710 Realtor Com

90 Griggs St Waterbury Ct 06704 Realtor Com

White Cap Beer 12oz Cone Waterbury Ct 1 000 Vintage Beer Labels Antique Beer Labels Beer Brands

26 Hotchkiss St Waterbury Ct 06704 Mls 170457313 Zillow

Waterbury Connecticut Ct Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

21 Lanzaeri 1 3 4 5 Waterbury Ct 06704 Mls 170413505 Coldwell Banker

Health In Waterbury Connecticut

Waterbury Police Department The City Of Waterbury Ct

Used Cars For Sale Under 10 000 In Waterbury Ct Cars Com

Crosby High School Waterbury Connecticut Ct Original Antique Postcard 1925 At Amazon S Entertainment Collectibles Store

Welcome To The Brass City City Of Waterbury Ct

35 Wall St Waterbury Ct 06705 Realtor Com

Clock Tower In Waterbury Ct Waterbury Connecticut Waterbury Favorite Places